More Insight Into the UK’s Top 100 Challenger Brands

When we launched the Trouble Making 100 (TM100) last week (the UK’s first ever ranking of challenger brands as seen through the eyes of everyday Brits) - we were blown away by the reaction. Hundreds of downloads, dozens of debates, and a LinkedIn repost from a partner at eatbigfish, the OG challenger brand thought leaders (swoon). We’re also thrilled to see so many downloads from marketers at some of the brands mentioned in the study.

The full report runs over 70 pages, packed with stats, insights, and a fair bit of provocation. But for those who haven’t yet dived in, I thought I’d share my ten favourite pages - the ones that got my brain whirring as I was writing it up. Perhaps they’ll get your brain whirring as well.

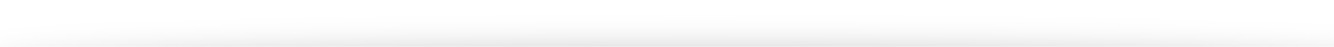

1. The Top 10 Brands

Let’s start where everyone wants to start: The Top 10. A glorious mash-up of different types of brands with different ways of being a challenger - from Ryanair, the “we don’t care if you hate us, you’ll fly with us anyway” bad boy of aviation, to the sleek upstart Nothing Electronics, to the wonderfully cheeky (cheeky? geddit?) Who Gives A Crap.

The diversity here says it all: there’s no single way to be a challenger. Our CCO at Trouble Maker would say what unites them is courage, not conformity.

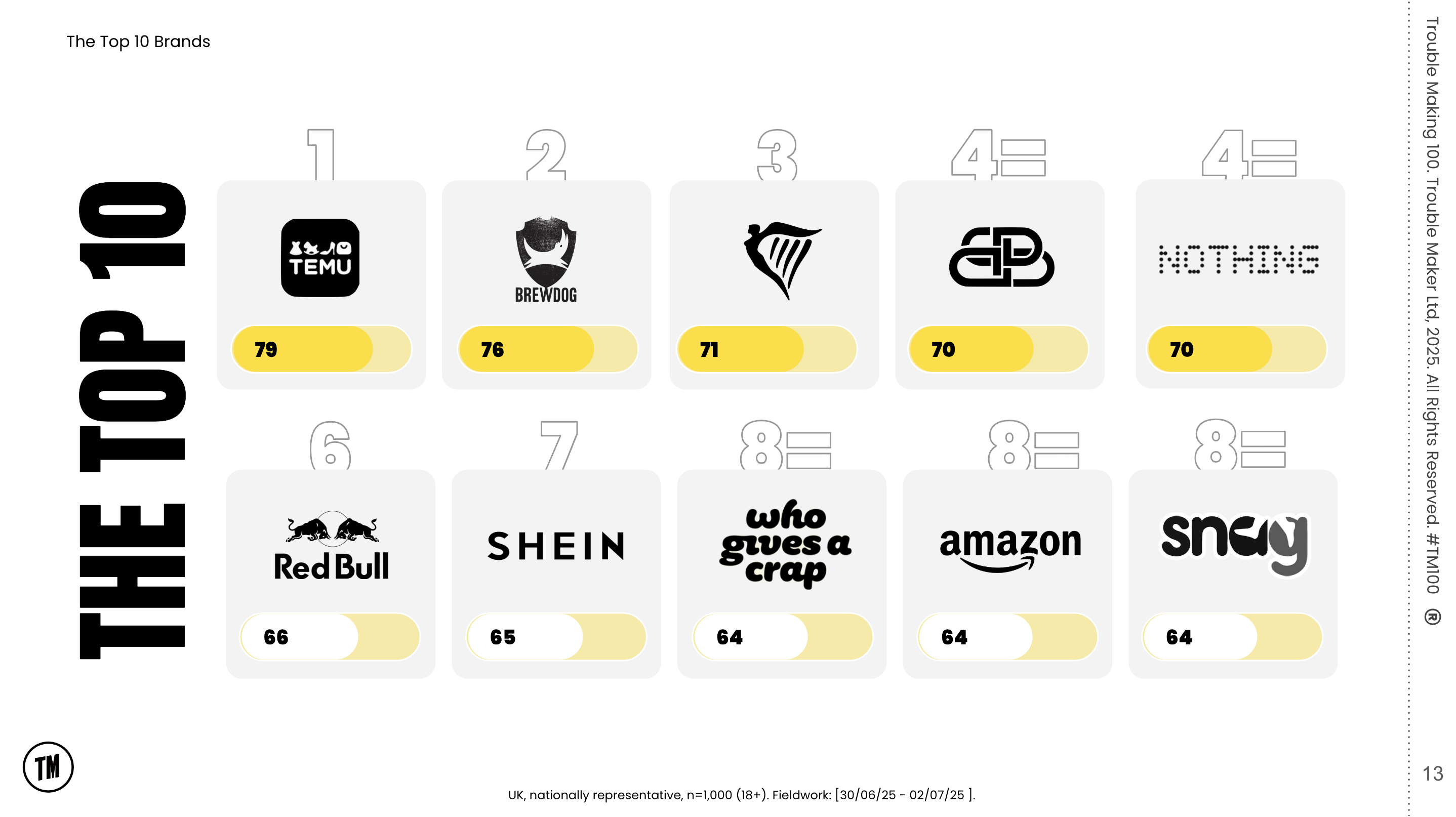

2. The Top 100

Let’s now zoom out to the full Top 100, and another story emerges. Some of our industry darlings - Oatly, Tony’s Chocolonely, Surreal, Greggs, all make the list (no mean feat, given over 500 brands were initially mentioned in the primer survey).

But what’s striking is who else is there. Brands that barely get a mention in the trade press are adored by the public. Who Gives A Crap, for instance, scored high with real people but low with the marketing echo chamber - just five headline mentions in the last 18 months compared to Oatly’s 24.

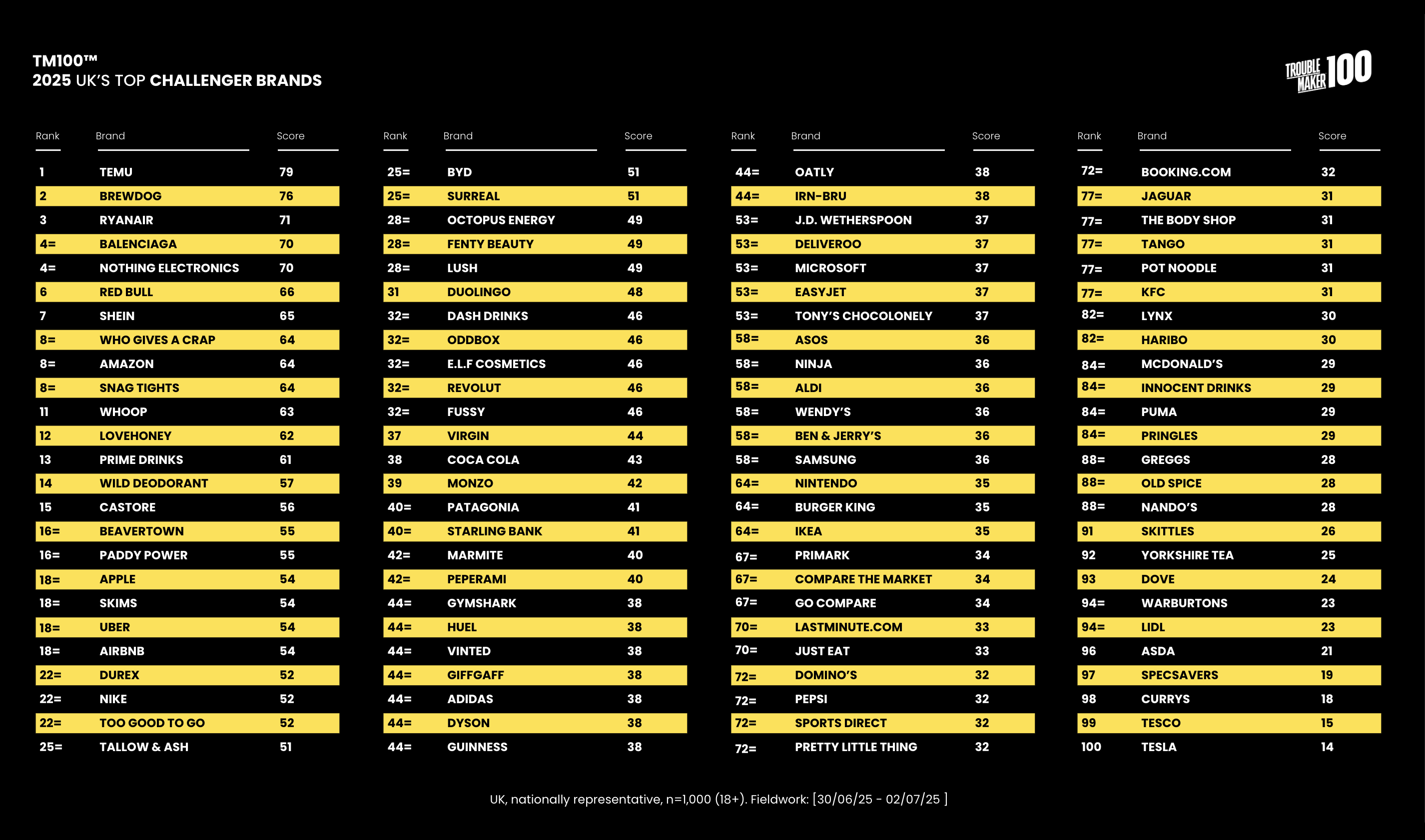

3. The Gen Z Top 15

Let’s dig a little deeper now. What happens when we cut the data by age? Enter Gen Z’s Top 15, where Prime Drinks shoots from #13 overall to #4 among younger consumers. Nike jumps from #22 to #5, and Duolingo rockets from #31 to #8.

Perhaps younger audiences aren’t just buying products - they’re buying personality (a theme we’ll revisit shortly).

4. The Rebel Mindset

Onto psychographics now. Let’s get into the psyche of everyday Brits - and not just their relationship with rebellious challenger brands, but their relationship with rebelliousness in general. On page 39 of the report, we asked: how rebellious are you? Half of the UK (51%) said they’ve got a rebel side, but that jumps to 60.4% among 18-24s.

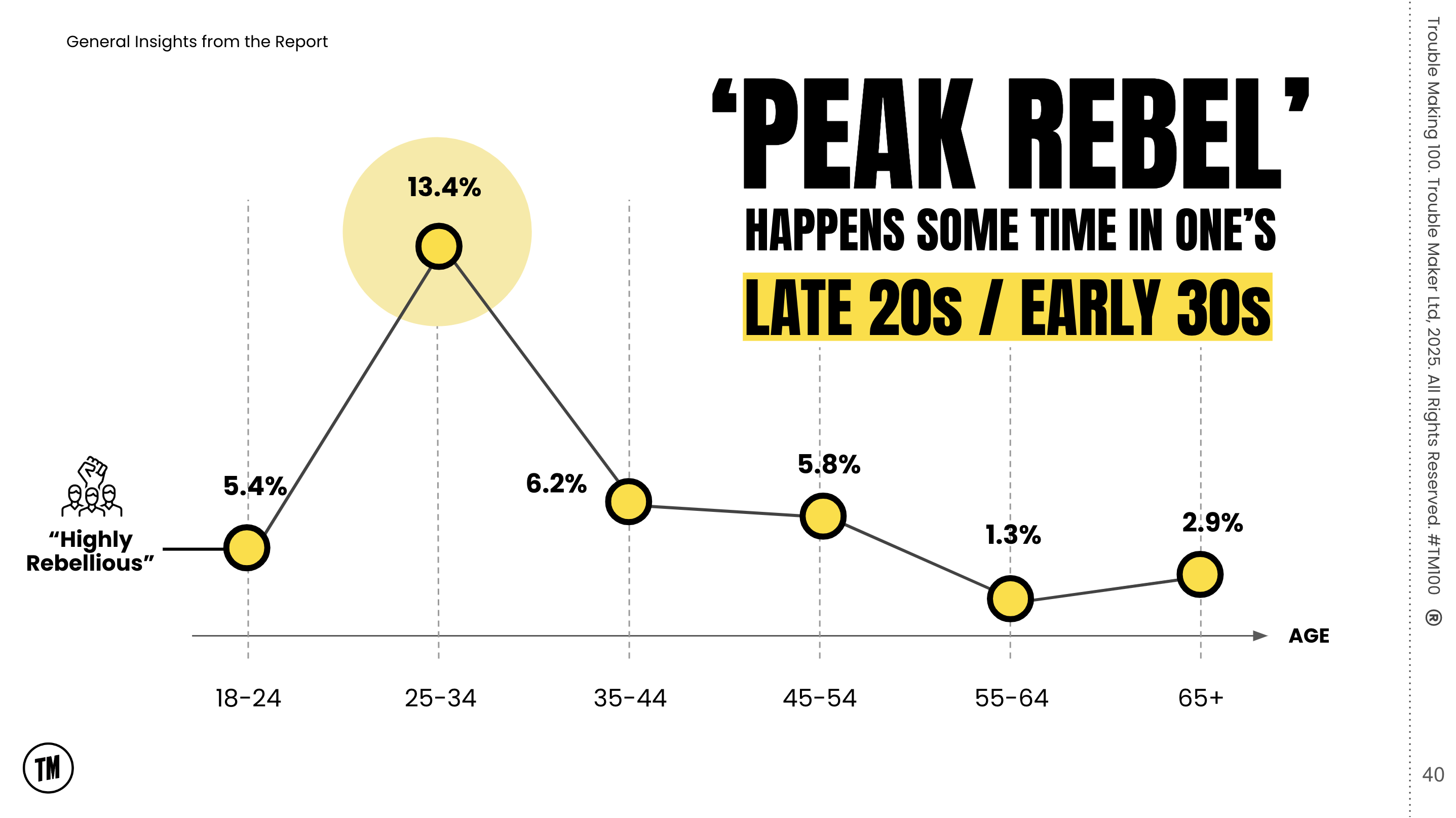

5. Peak Rebel

When we dig deeper into “highly rebellious” responses, we find peak rebel hits somewhere between your late 20s and early 30s. Which makes sense to this middle aged author (young middle age though) - old enough to know the rules perhaps, but young enough to still want to break them.

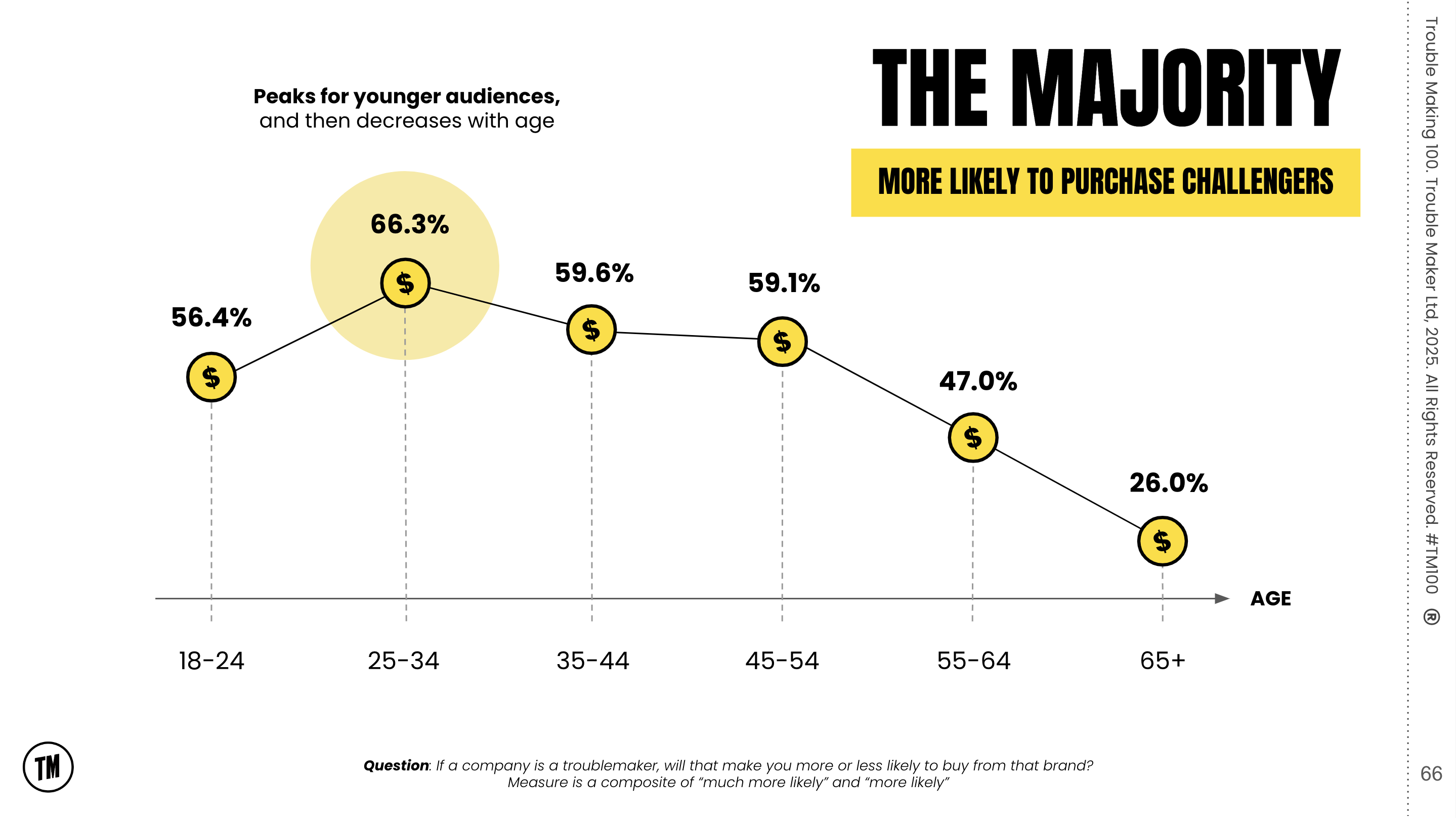

6. The Challenger Buyer

But what is the utility of knowing who is rebellious and who is conformist? Why is this important in the context of Challenger Brands? Well let's look at page 66 of the report, where we can see that 66.3% of 25-34-year-olds are more likely to buy brands they deem challengers or troublemakers, compared to just 26% of over-65s.

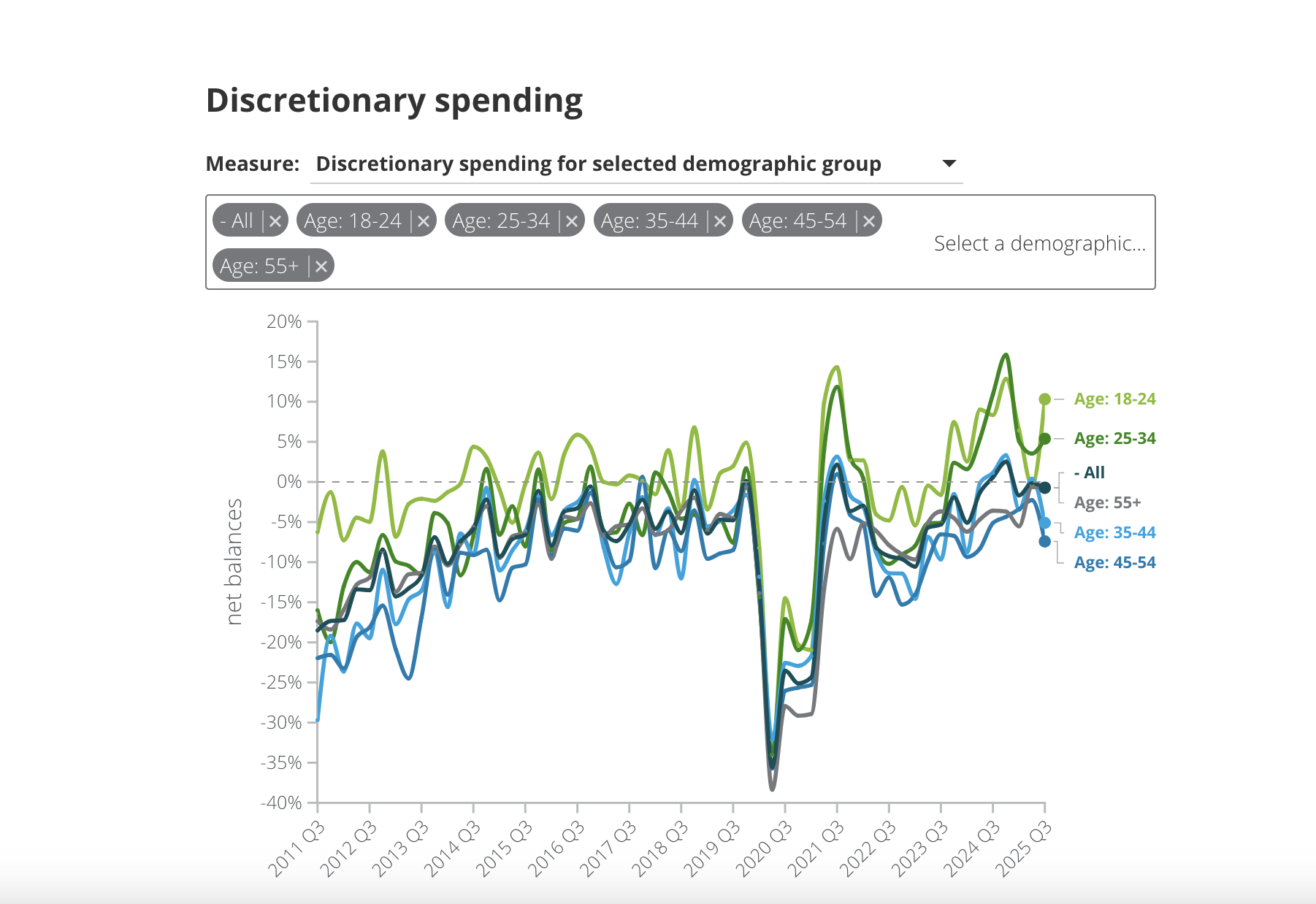

Add to that the fact that discretionary spending also peaks among younger consumers (thank you, Deloitte Consumer Tracker Q3 2025), and you’ve got a perfect storm of rebel-minded, spend-happy audiences waiting to be inspired.

But enough about Deloitte's graphs being slicker than mine, let's keep going - on to favourite page number seven...

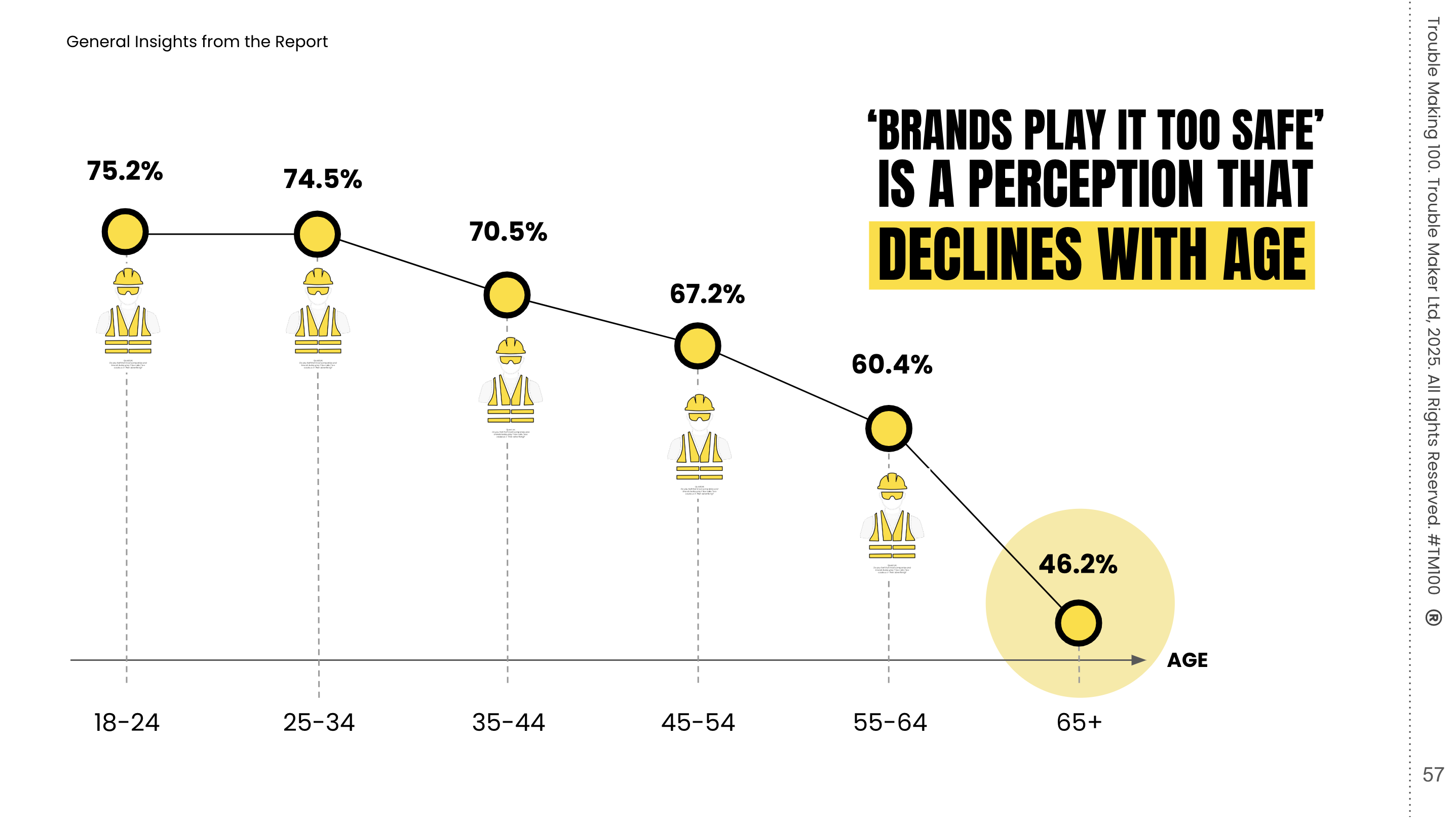

7. Safe Is Risky

So they're rebellious, buy challengers, and spend the most of any age group. Great ! …but are they currently inspired by your marketing? Sadly the answer is there’s a 3 in 4 chance that they think you are bland. Two-thirds of the population already think UK brands are too cautious, and that figure rises to 75% for younger audiences.

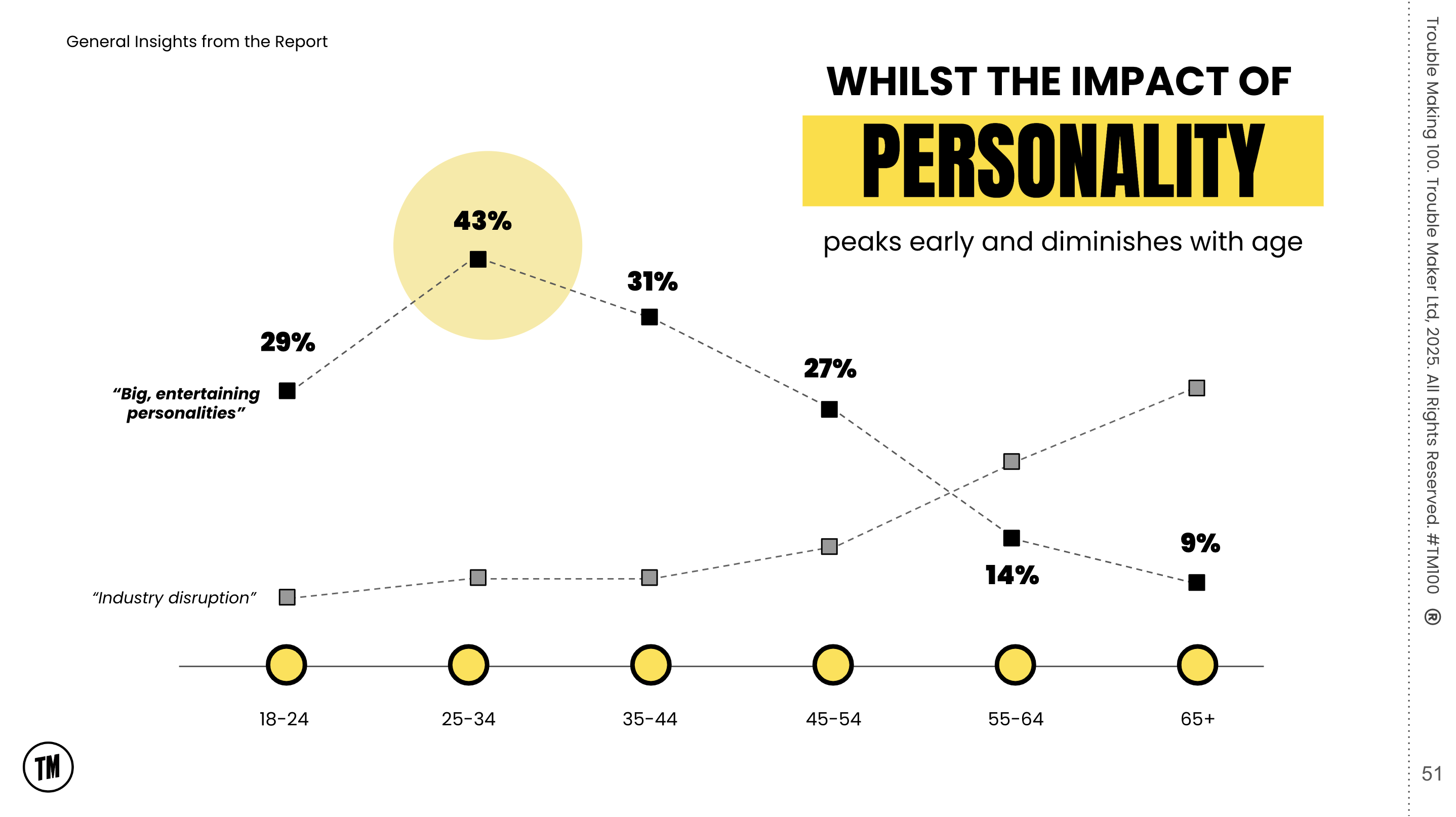

8. What They Actually Want

So, what do they want instead? On page 51, younger audiences tell us that “big, entertaining personalities” top their list - trumping even the classic challenger brand synonyms and proxies of “industry disruption”. This perhaps part-explains why the loud, brash and incredibly cheap disrupters TEMU and SHEIN placed so highly in our study (it might make sense that they do, during such economically challenging times for many Brits) despite their apparent lack of technological innovation or advertising genius. Big, bold and bodacious brands lovehoney and SKIMS also placed in the Top 15 list for younger respondents.

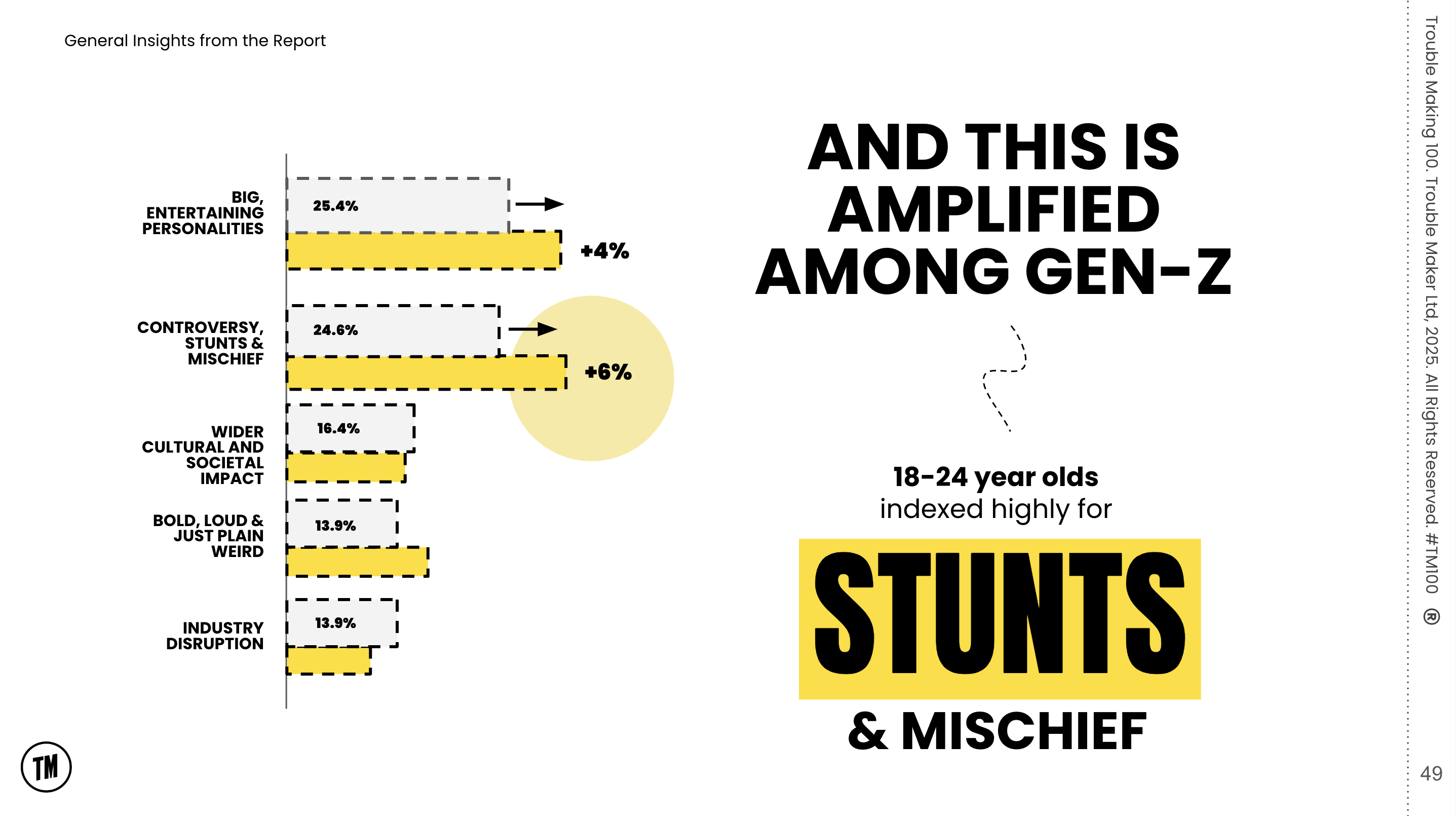

9. Mischief Matters

And how should those personalities show up? Page 49 tells us: through stunts and mischief. Six percent more of this group prioritise playful, provocative behaviour than the national average. Another interesting statistic from the report showed that 18-24s felt they understood the phrase “trouble making” more than term “challenger brand” (the only age group that did so), so perhaps a little trouble is just more relatable for the younger audiences.

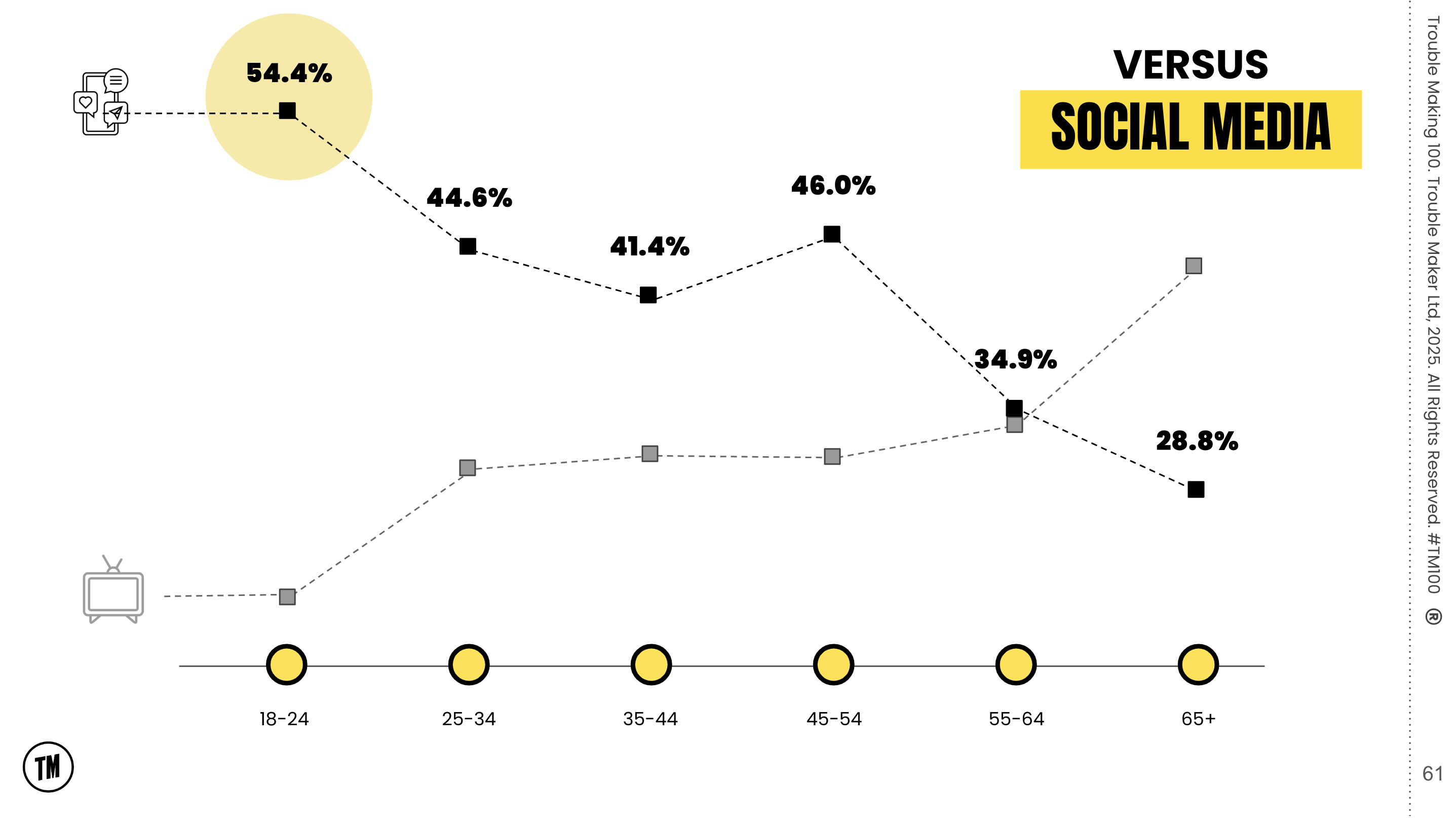

10. The Media Playground

And finally, the 10th of my favourite 10 slides from the report - which shows the media environments that you might prioritise for your big personalities, mischief and stunts - namely social media. It peaks for younger audiences and then decreases with importance as television becomes the priority channel for engaging with challenger brands.

So there you have it.

So there you go, dear reader. Ten of my favourite slides from the TM100, all telling a little slice of the UK challenger brand story, each with implications that brands and agencies might make actionable decisions from. A snapshot of a much bigger, more nuanced story about how Brits perceive and respond to challenger behaviour.

There's an Aladdin's cave and 68 more pages of juicy insight from our inaugural study into challenger brands - so if you like what you’ve seen here, go download the full report, dive into the data, and find your own ten favourites. Because in the words of one of our top-ranked troublemakers, “The rules are there to be broken”

Download the full TM100 report here- and if you’d like to chat about what this means for your brand in 2026 and beyond - please do reach out!