When Spotify Thinks You’re 64: Radio’s Got Your Back

“How old? What? Did you just call me a geriatric?”

That was the reaction I kept hearing when Spotify’s listening age feature dropped into Wrapped summaries. One of our youngest, and arguably coolest, team members at Radiocentre was told her listening age was 64. Mine? A sprightly 65. I’ll let you guess my actual age (spoiler: Spotify knows, and it’s at least a decade or two younger), but honestly, what a strange gift to give your customers: insult the very people who pay you by mining their playlists.

And yet, we all laughed it off and accepted it. Because hey, it’s Spotify, so it must be cool, right? Meanwhile, the annual Wrapped frenzy was done to death, dominating LinkedIn etc with tenuous links to advertising made for column inches.

I do actually quite like the whole Spotify Wrapped phenomenon. I wouldn’t share my sometimes-questionable taste with others, but I like to look at what I’ve listened to over the last 12 months. What I really like is that it does a great job of reminding people how incredibly important audio is to listeners.

But here’s the thing: for advertisers, it’s not about quirky made-up metrics of fake listening ages. It’s got to be about who’s listening, what platform they’re on and, yes, probably even how old they really are.

The real story: audio audiences are thriving

Unlike streaming platforms, broadcaster-owned and operated audio – particularly radio – has no shortage of robust, transparent and independently-verified data. Fresh from the latest RAJAR MIDAS Autumn 2025 report (thanks to our insight team for crunching the numbers), here’s what brands need to know:

Commercial radio isn’t just for older listeners. Yes, it has its fair share of them (often wealthier too tbf), but we also dominate among harder-to-reach younger audiences.

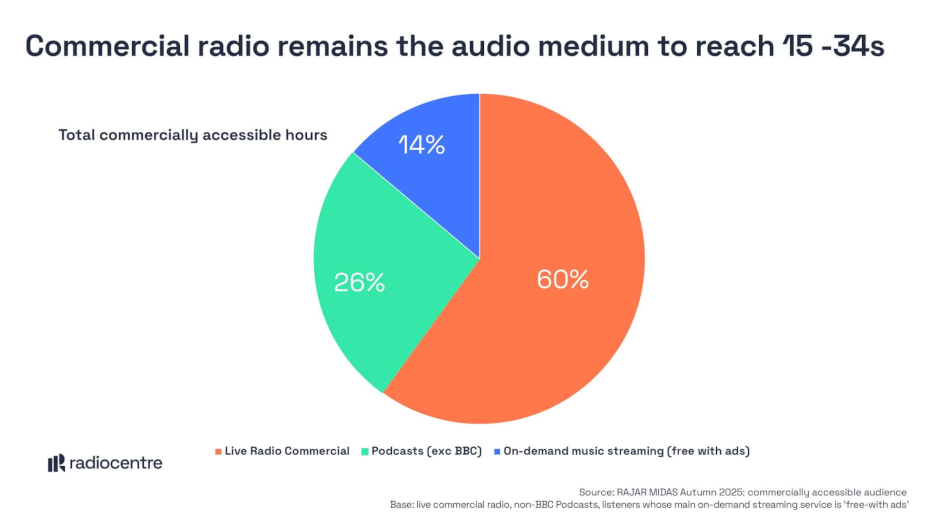

For 15–34-year-olds total commercial audio weekly reach has grown by 18% since Autumn 2023. 60% of commercially accessible listening hours among this audience are with commercial radio. 26% are with non-BBC podcasts. Just 14% of hours are with ad-funded streaming services.

So if you’re planning audio campaigns, commercial radio is still the heavyweight champion for younger demographics.

Commercial audio: bigger, stronger, more digital

The Autumn 2025 MIDAS report marks a milestone:

- Commercial audio listening hours have grown 21% since 2019, now hitting 707 million hours per week (up from 581m in 2019).

- Digital audio – radio streams, podcasts, and ad-supported music streaming – has been at the heart of this growth story and nearly doubled in listening time since 2019, driven by connected devices and evolving habits.

Broadcast radio remains dominant, but the surge in digital formats shows how audiences are diversifying their listening.

Why this matters for advertisers

Earlier this year, Radiocentre’s Speed of Sound report highlighted that commercial broadcasters deliver scale across both broadcast radio and digital audio, accounting for around 90% of total commercial audio listening. This ensures advertisers can reach audiences effectively across platforms.

And if ROI is your priority, our High Gain Audio study (in partnership with WPP) revealed that both broadcast radio and digital audio outperform the all-media average in short-term and full ROI. For the best results, use highly engaging music, which recent research suggests increases campaign ROI by an average of 32%, illustrating again the emotional pull that music has on listeners.

Key takeaways for advertisers:

- Be more ambitious with audio budgets, given audio’s superior ROI.

- Supplement broadcast radio with digital audio – don’t replace one with the other.

- Use robust inputs to understand each audio element’s unique contribution to campaign success.

Spotify might think you’re 64, but the truth is audio audiences are valuable, vibrant, diverse, and growing. For advertisers, the opportunity isn’t in Wrapped stats – it’s in leveraging the true scale and effectiveness of commercial audio across broadcast and digital as both are in great health.

Lucy Barrett is client director at Radiocentre.