“Be Surgical with Your Targeting”: How Citizen Relations Is Redefining Gen Z Marketing

While marketers across the industry have been trying to nail down the secret of securing consistent gen z attention for quite some time, it’s been an experiment which hasn’t yielded consistent results. Sure, brands are able to land campaigns with a degree of relative success from time to time, but nobody has really found a one-size-fits-all secret to decoding this generation’s wants, yet.

The thing is, according to the research of Citizen Relations, there is no ‘one-size-fits-all secret’. Rather, from career ambition, to risk-taking appreciation, financial wellbeing, and variable willingness to adopt tech, there are a multitude of factors which drive this demographic’s spending power – something expected to reach $12 trillion by 2030. Elements which fracture gen z into a host of unique subtypes – each with their own buying habits – this proved the perfect point of exploration and explanation in ‘The Gen Z Collective’ report, released by the agency earlier this year.

Designed to look beyond the stereotypes, focus on data-driven insights, and share global examples of marketing for gen z done right, this research distilled these assorted groups into five specific ‘personas’. Introducing the ‘Status Architects’, ‘Beta Testers’, ‘Value Vigilantes’, ‘Risk Junkies’ and ‘Anxious Avoiders’, each came with its own unique set of traits, influenced by analysis that surveyed people within each respective category. All information you can learn more about by downloading the report, it’s a fascinating set of findings which brands and agencies may find valuable in their 2026 creative endeavours.

LBB’s Jordan Won Neufeldt sat down with Citizen’s global CEO, Nick Cowling, to learn more about this research, and dive deeper into some of its key takeaways.

LBB> From the top, what inspired you to launch The Gen Z Collective, and what made now the right time to do it?

Nick> At Citizen, we believe in understanding the people behind the action, the purchase, and the opinion. The Gen Z Collective (which is part of a larger Citizen GenLens programme to deeper understand consumer behaviour across generations) was born from that core philosophy, because we kept seeing the same mistake: brands trying to lump this entire generation into one or two boxes.

The reality is, gen z is incredibly complex, and the sooner we understand those complexities, the better we’ll get at connecting with this key group. Their buying power is set to hit $12 trillion by 2030. Despite this, they’re still marketing’s most desired and expensive unsolved puzzle. Now is the time to offer a solution that helps ambitious brands stop guessing who gen z is, and stop chasing fleeting micro-trends. This research is a powerful tool to help brands move beyond guesswork and build a much stronger, more authentic consumer strategy.

LBB> In your opinion, to this point, why has gen z been such a tricky group to nail down?

Nick> The primary obstacle is that gen z is the world's most paradoxical consumer. Brands often find their marketing strategy paralysed by these contradictions. For example, you have a generation that is ‘chronically online’, but they’re also worried about data privacy.

It is impossible to market effectively when your audience is running in opposite directions, and brands have historically been stopped by generalisations and oversimplifications. Many marketers assume all gen z are digital natives who exclusively exist online, but that ignores the nuance of specific groups who actually prefer anonymity or finding community outside the digital landscape.

LBB> With that in mind, what was your research process like? How did you come to develop and define these specific personas which brands haven’t met yet?

Nick> Our process began by exploring common stereotypes and misconceptions about gen z, and our intelligence and insights team analysed that aggregated data from GWI’s consumer research. We looked specifically for significant variance in responses related to career goals and attitudes toward risk.

From there, we started identifying emerging patterns regarding how this generation foresees the economy, where they find community, and what they value most. We decoded the generation through four specific lenses that shape their buying decisions: career ambition, risk-taking, financial behaviour, and technology adoption.

This data-driven approach allowed us to create a thematic categorisation that moves beyond surface-level trends. What we saw was complex – and often contradictory – behaviour, which proved gen z doesn’t move as one.

LBB> As part of this, how did you ensure you got beyond the stereotypes to truly understand and capture the nuances of each of these personas? What were some of the key themes you discovered?

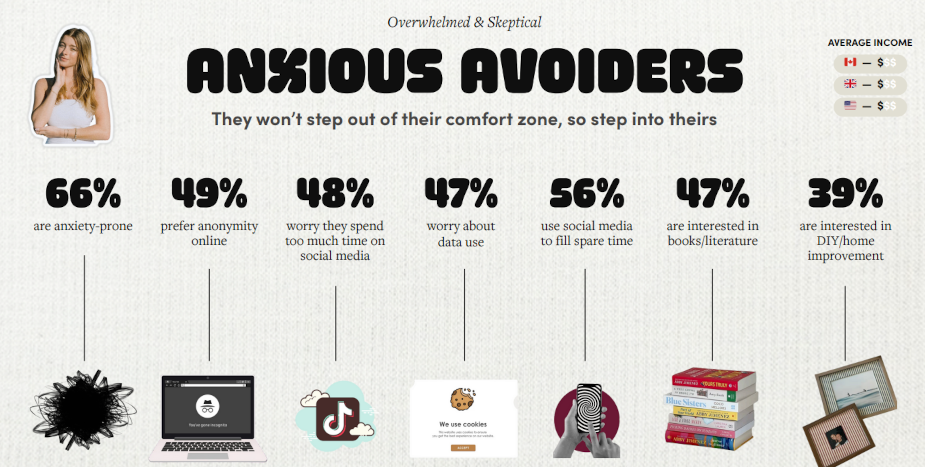

Nick> We ensured we went deeper by investigating the factors that drive every aspect of their being, such as their aversion to risk and financial decisions. And, as our intelligence and insights and marketing teams were putting this together, some of our gen z ‘Citizens’ were excited to see themselves in the different personas; we have a few ‘Risk Junkies’ and ‘Value Vigilantes’ in our midst!

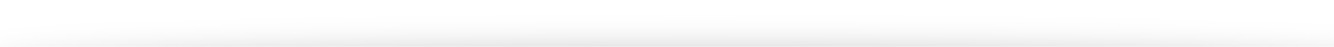

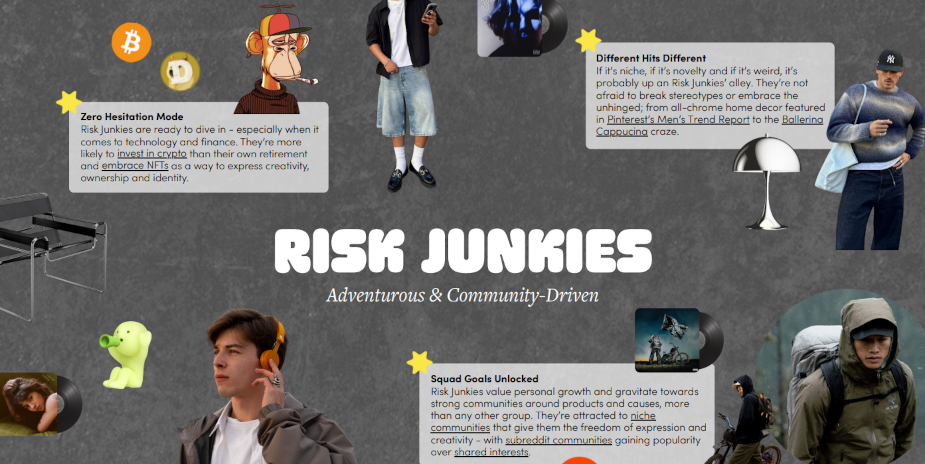

We also discovered distinct themes for each group. For instance, ‘Status Architects’ value success and standing out, but they are redefining luxury to include high-end groceries and wellness clubs rather than just fashion. Conversely, ‘Value Vigilantes’ prioritise family values and trust; they hold brands to a higher standard regarding ethics and social justice. We also found that while ‘Beta Testers’ want AI to take over their work, ‘Anxious Avoiders’ are retreating toward a softer, slower-paced lifestyle.

LBB> Broadly speaking, what were some of the most interesting takeaways you came across? Why did they stand out to you?

Nick> One of the most interesting takeaways involves the ‘Status Architects’. Our data found that while 53% research products online before buying, their definition of ‘premium’ is unique; their biggest splurge is often groceries, opting for higher-quality products that align with their lifestyle and wellness goals.

Another standout was the paradox of the ‘Anxious Avoiders’. We found that 66% are anxiety-prone, and 47% worry about data use, yet 75% still consume social media passively. They are constantly doomscrolling despite their scepticism, which signals a massive opportunity for brands to offer them the comfort and ‘chill vibes’ they are frantically searching for.

LBB> In the same vein, did anything catch you off guard?

Nick> I was definitely the most pleasantly surprised by the ‘Risk Junkies’. They are quite unexpected because, while they are tech-savvy and ambitious, they are not at all influenced by digital advertisements. In fact, only 17% of them discover brands on social media. They are the quirky, unpredictable ones who crave belonging and community, but tend to tune out traditional messaging.

LBB> Did you find that income played a role in which demographic respondents fell into? How is cost of living impacting gen z’s spending habits across these various personas?

Nick> We found that financial behaviour varies significantly by persona, rather than just income bracket. For example, ‘Value Vigilantes’ are practical; 77% spend cautiously and are focused on maximising loyalty and rewards programmes to ensure financial security.

In contrast, ‘Status Architects’ are willing to spend to maintain an image; they desire luxury and are more loyal to premium products. Meanwhile, ‘Beta Testers’ are money-driven and act as early adopters who are willing to take risks on new brands and technologies. It’s less about how much money they have, and more about what motivates their purchasing decisions.

This is a generation that is no stranger to economic uncertainty, spending their most formative years during and in the aftermath of a global pandemic. The cost of living crisis and inflation do impact their behaviours, but what each persona chooses to prioritise and spend their money on is rooted in those distinct values.

LBB> You also included advice on how to meaningfully connect with each group. Can you give us some examples of what this looks like when done well?

Nick> Connecting with each of these personas means aligning with their specific cultural triggers. For example, ‘Risk Junkies’ value being part of a unique community where they feel like they belong, and streetwear brand Stüssy tapped into this audience with its recent resurgence. By focusing on brand and product instead of flashy marketing or influencer campaigns, it’s regained its popularity with a younger audience.

‘Status Architects’ are at the forefront of culture, and connecting with them means being right there with them. Take the success of TV shows like ‘The Summer I Turned Pretty’, or ‘Love Island’. Audiences, primarily gen z, were enamoured all around the world. From hosting weekly watch parties and filming their live reactions to proper debates on Threads, TikTok and Reddit, these shows took over a moment in culture. The smart brands turned watch parties into fan experiences, making sure to remain memorable with this audience.

LBB> Of course, connecting with specific subsets of gen z is probably easier said than done. Do you believe that brands need to commit to connecting with only one of these personas at a time?

Nick> You certainly cannot use a ‘one-size-fits-all’ approach. When you treat the generation as a monolith, you risk hitting ‘Status Architects’ with messaging meant for ‘Value Vigilantes’, resulting in zero engagement and wasted budget.

However, connection isn't just about isolation; there are shared behaviours across the generation, particularly the demand for authenticity. Gen z can see through disingenuity immediately. The goal is to be surgical with your targeting – using data to understand exactly who drives your market – while ensuring your brand's core purpose is genuine enough to resonate broadly. By understanding the person and not just the consumer, brands can build strategies that speak to a specific reality without alienating others.

LBB> To this end, what advice would you offer Canadian brands and marketers, based on these results? What should more people be cognisant of going into 2026?

Nick> The most critical piece of advice is to shift your mindset from ‘trendjacking’ to ‘trend driving’. Too many marketers are trying to ride the wave of a fleeting micro-trend that will likely tank by tomorrow, rather than understanding the behaviour that caused the wave in the first place.

As we look toward 2026, marketers must be cognisant that gen z moves fast. You cannot hit a target moving this fast with a blanket strategy. If you want to hold their attention in the coming years, you have to be surgical, authentic, and consistent, because they can spot disingenuity instantly.

LBB> Finally, what is Citizen taking away from all of this? How are you using this data to improve your own approach?

Nick> For us, this reinforces that understanding the person – not just the consumer – must be at the core of our business. We are taking away the confirmation that a singular view of gen z is a blind spot that leads to wasted budget and brand friction.

We are using this data to ensure we never fall into the trap of generic segmentation. We are deploying proprietary tools like our 'Performfluence' model, which combines influencer strategies with performance metrics to ensure we are hitting the right pockets of this generation. We are also utilising our ‘Whole Search’ approach to optimise how clients show up in the age of generative AI, ensuring we capture gen z across the full search ecosystem.

And gen z is just the beginning. Ultimately, we’re using this intelligence to build integrated teams that move simultaneously and build strategies that resonate with the person behind the consumer, whether they’re gen z or baby boomers. We don't just want to give clients data; we want to give them actionable foresight to make bold moves in uncertain times that deliver the highest impact, no matter who their audience is.